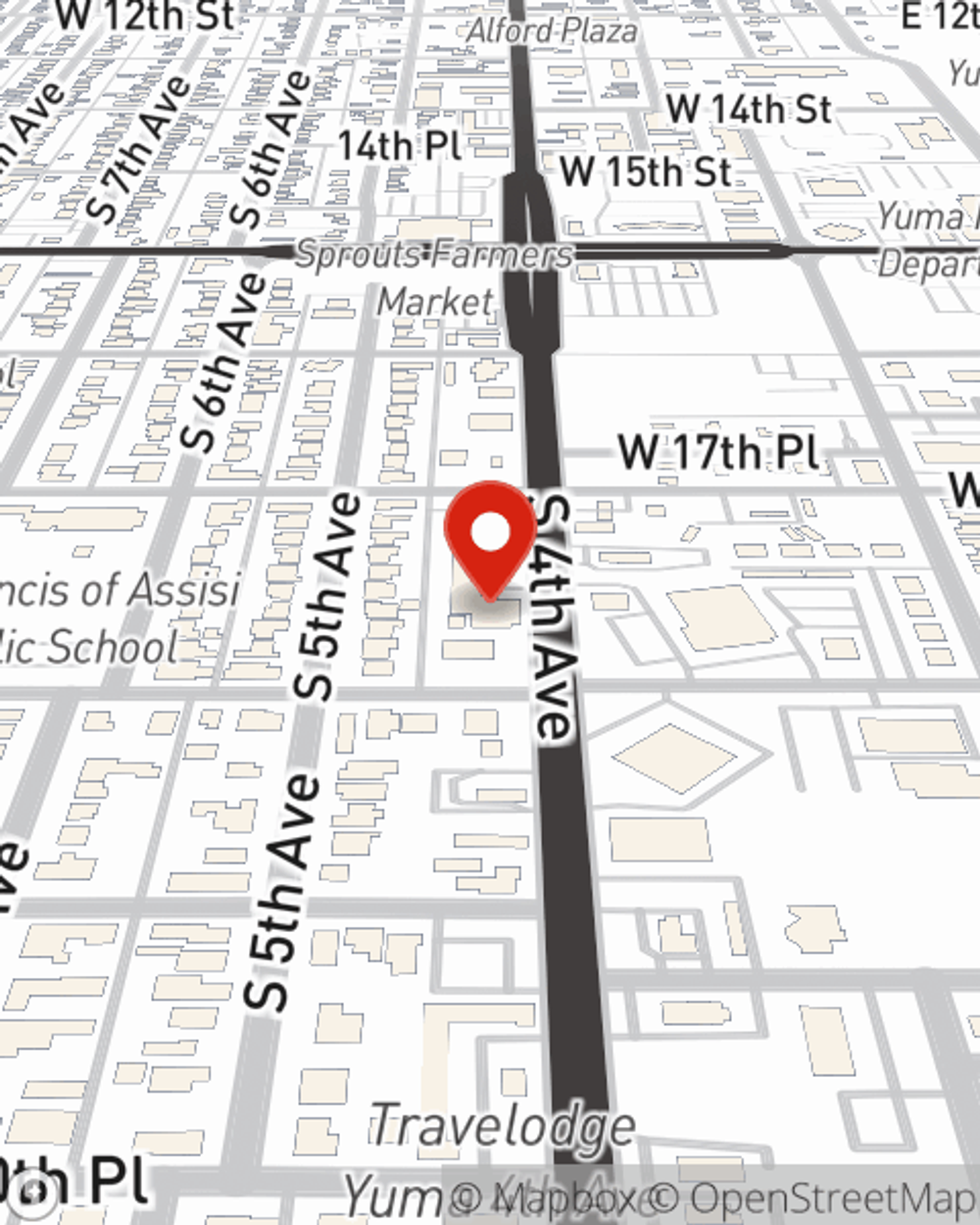

Renters Insurance in and around Yuma

Get renters insurance in Yuma

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Yuma

- The Foothills

- Somerton

- San Luis

- Wellton

- Dateland

- Buckey

- Martinez Lake

- Phoenix

- Avondale

- Tolleson

- Gadsden

- Scottsdale

- Gilbert

- Mesa

Protecting What You Own In Your Rental Home

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected loss or mishap. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Katie Figueroa is ready to help you prepare for potential mishaps with reliable coverage for your renters insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Katie Figueroa can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Get renters insurance in Yuma

Renters insurance can help protect your belongings

There's No Place Like Home

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your valuable possessions with coverage. In case of a break-in or a fire, some of your possessions could have damage. Without adequate coverage, the cost of replacing your items could fall on you. It's scary to think that in one moment, everything you own could be lost or destroyed. Despite all that could go wrong, State Farm Agent Katie Figueroa is ready to help.Katie Figueroa can help offer options for the level of coverage you have in mind. You can even include protection for valuables if you take them outside your home. For example, if a pipe suddenly bursts in the unit above you and damages your furniture, your personal property is damaged by a fire or your bicycle is stolen from work, Agent Katie Figueroa can be there to help you submit your claim and help your life go right again.

It's always a good idea to make sure you're prepared. Reach out to State Farm agent Katie Figueroa for help understanding coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Katie at (928) 782-FARM or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Katie Figueroa

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.